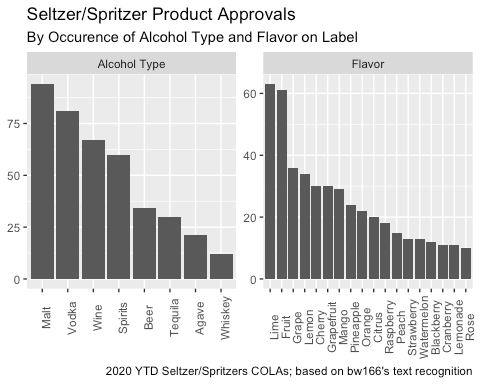

Following up on our post yesterday (The Increasing Fragmentation of Seltzers) and the recent Beer Business Daily article (A-B Jumps into the Ranch Water Game), we decided to dive deeper into who’s launching Tequila/Agave-based products using bw166’s latest tool, Label Inquiry.

Looking directly at Tequila Seltzers and Sodas, we have several recent product approvals:

- Nude Tequila Soda in three flavors: Grapefruit, Pineapple, and Lime

- Proof Point Tequila Seltzer with a Grapefruit Splash

- Dulce Vida Tequila & Soda Pineapple

- Capriccio Ranch Water Mang Passion

- Hornitos Tequila Seltzer in three flavors: Lime, Mango, and Pineapple

- Lakehouse Cocktails Spicy Tequila Cocktail

- Jose Cuervo Sparkling Margarita (not labeled a Seltzer but at 150 calories and 12 proof, it generally fits the segment)

Another category extension is margarita ice pops. Two brands have recently received product approvals: Sloshee (a margarita flavor at 20 proof) and Cazul 100’s Spirit Pops (in Lime Margarita, Mango Margarita, and Strawberry Margarita – all 100 calories and 16 proof).

There is also a proliferation of agave-based wines and cocktails, with brands such as Playa Vallarta, Agavino, and Agavales all receiving recent TTB approvals. Additionally, larger suppliers are playing this space. Bronco Wine Company received approvals for two labels of La Catrina (Classic Margarita and Strawberry Margarita). Don Sebastiani received approvals for wine cocktail kegs for their Flybird brand (in Strawberry Margarita and Baja Lime Margarita)

Even Michelob Ultra is playing in the agave-flavor space with recent approval for an Infusions Pomegranate & Agave light lager.

Lastly, while not in the Tequila-space, Jim Beam is receiving label approvals for products such as Jim Beam Ginger Highball, Jim Beam and Cola, and Jim Beam Classic Highball (all ten proof with calorie counts between 105 and 250 calories).

These are just a handful of the recently approved products entering this space. Some of these big-name brands and suppliers may have enough clout with retailers to acquire valuable shelf space. Still, only time will tell if they’ll generate the same consumer pull relative to the existing products like White Claw and Truly.

For more details regarding our Label Inquiry application, please visit our Introducing Label Inquiry page.